In recent years, the real estate market has rebounded, and an improving economy means more and more Americans are finally following their dreams of home ownership. For some, that means building their own custom dream home.

If you’re interested in building on Oklahoma land, however, there are many different factors to consider before you get started. Having realistic expectations of the issues and complications that can arise when building in Oklahoma will prepare you for any hurdles on your home building journey. Read on for more information about the ins, outs, ups, and downs of building on Oklahoma land.

To most people, land is just an expanse of earth ready to be developed by the first person who buys it and sticks a house on it, but there’s so much more to the ground you walk on than meets the eye. Soil type, drainage, topography, location, and more all determine if a lot meets criteria for easy building or if it will need more work than it’s worth to make it habitable. Save yourself the inconveniences that many home builders find by preparing for the worst and doing your due diligence.

Whether buying a pre existing home or building new, every homeowner’s first consideration is budget. Building on your land sometimes comes with a few surprises. But you can mitigate the consequences of those surprises by making some smart decisions early on, like creating a comprehensive budget that takes into account the many possible pitfalls of buying land.

To get you started, I’m going to give you a hypothetical scenario where you have a budget of $250,000 to build your house, but you don’t actually get to spend all that money on the house itself. Instead we’re going to walk through a few key items to think about as you make your budget and what I suggest you plan on spending for each.

Unlike a developed lot in a subdivision, the land you have in mind might be out in the country a bit with only a few neighbors per square mile. That land is nowhere close to build-ready. You might need to remove a bunch of trees, move around a whole lot of dirt, and maybe even bring in or haul off extra dirt. That can mean hours of labor for a guy on a bulldozer.

Unlike a developed lot in a subdivision, the land you have in mind might be out in the country a bit with only a few neighbors per square mile. That land is nowhere close to build-ready. You might need to remove a bunch of trees, move around a whole lot of dirt, and maybe even bring in or haul off extra dirt. That can mean hours of labor for a guy on a bulldozer.

Your home site might be several hundred feet from the road, which means building an access road for use during construction that will later become the driveway. That might involve a drainage culvert and several loads of gravel.

When preparing your initial budget, I advise using $5,000 minimum for preparing the land. But I've seen site preparation costs range anywhere from $1,500 to $70,000. It all depends on the land you're building on.

Most rural land requires drilling a well since it's not serviced by city water or even a rural water district. That's not always the case, but if it is, you'll need to budget for the cost of a well.

Ask around the community for the recommended well company. Usually there's a local company who has drilled enough wells in the area that they can give you a pretty good idea of cost.

But keep in mind that the cost of a well is directly related to the depth, and the depth won't be known until the contractor drills deep enough to find good water at a reasonable volume. In my experience, a budget of $6,500 for a well is pretty safe.

As with water service, most rural home sites aren't served by a city sewer system. In fact, I've built in several areas where water is available but sewer is not.

It's a matter of the distance from the nearest water treatment plant and the fact that the sewer main has to run downhill the whole way. If your land is too far away, the pipe would be lower than the treatment plant by the time it got there.

In many areas of central Oklahoma, the soil has enough clay that it doesn't percolate well, so we mostly see aerobic septic systems being installed. Modern systems are extremely reliable and effective, and the cost typically runs about $6,200.

While the above three things account for the majority of your land preparation costs, there are other things to consider in your budget beyond just the cost of your house. Think about any exterior concrete, such as driveways and patios, as well as landscaping, sod, fencing, etc.

Don't forget to factor those into your overall budget.

Let's go back to the original $250,000 budget for your home. Now subtract the first three items above, which total around $18,000. That leaves you with $232,000 for the house, which gives you a more realistic idea of your budget. It's always a good idea to shoot for something a bit more conservative to give yourself a buffer, so start at about $220,000 for cost to build your home.

With the right budget up front and the right expectations about the process and what it will cost, the process of building a home on your land will be much smoother.

For many people, an unexpectedly difficult part of building a custom home is finding the right place to build. Perhaps you've been searching for a while and you're getting a little frustrated with the process. But then you find a great deal on the last available lot in a particular area. Lucky you! Or maybe not.

There's a reason that lot you're thinking about buying is still vacant. Your job is to figure out if that reason is a deal-killer or not.

I’m going to let you in on a little secret: when a land developer starts selling lots, he usually doesn't vary the prices enough to account for the real differences in desirability. As a result, the lots get cherry-picked, either by builders, the people buying the custom home, or both. Here's what that usually means:

-The best, most desirable, and/or easiest-to-build lots get sold first.

-The toughest lots to build on are the ones that sell last.

-There always seems to be that "dog" lot that nobody wants.

-Years later, that lot is still sitting there and nobody is around who remembers why (or they aren't willing to volunteer the information).

The unsuspecting buyer who's looking to build a house on her own land comes along and thinks she's found a hidden gem. But it's highly likely there's an issue of some kind, such as:

-Drainage. Maybe that lot is the gutter for the entire neighborhood or maybe it's in a 100-year flood plain.

-Soil condition. Maybe there's some subsurface rock that's going to be tough to excavate. Or perhaps the owner of the land 75 years ago used to burn the trees he cut down and now there's ten feet of organic soil that will have to be removed.

-Weird shape, easements, or building lines that mean any house built there would have to be a 1,000 square foot two-story house with a one-car garage in order to fit.

We once had a client with a lot he had just bought in a neighborhood that had been developed some 20 years prior. He got a really good deal. But then we discovered a problem. The FEMA floodplain maps had been redrawn in the interim, and the house would need to be raised seven feet above the existing level of the land. With costs for concrete, labor, fill dirt, etc., it was going to take $70,000 to make that lot suitable for building. That $20,000 lot became a $90,000 lot.

Moral of the story: if you're looking at the last lot in a development, be sure to do your homework first.

If you're dreaming of building a new home on your own land and haven't bought land yet, one of the things to think about first is a septic system. Yes, that’s not the most exciting part of your dream home, but it’s an important consideration when picking a lot to build on and part of doing your homework.

If you're dreaming of building a new home on your own land and haven't bought land yet, one of the things to think about first is a septic system. Yes, that’s not the most exciting part of your dream home, but it’s an important consideration when picking a lot to build on and part of doing your homework.

There are different types of systems, and the type you choose will largely depend on soil type. Come to think of it, "choose" is probably the wrong word—the soil type, along with the government entity that regulates on-site sewage disposal systems will "dictate" the type of septic system.

If you have a strong preference, definitely do your research on what type of system a particular piece of land will require. If you don't have a strong preference, it might be a good idea to do some research on the various systems and their pros and cons before you commit.

There is some really good information on septic systems, maintenance, service contracts, and soil analysis available from the National Environmental Services Center. I’ve also listed the three main types of septic system you probably need to know about.

The percolation test, or perc test, is the biggest factor in determining which type of system is best. This test involves digging three holes of a certain depth, pre-soaking them with water, then refilling the water to a certain level and timing the water level drop to determine the soil's ability to allow water to percolate through it. If the water percs fast enough, you can use the standard tank and drain-field type system. This is the system most people think of when they use the term septic system. It has no mechanical parts, so it's simple and the most reliable, assuming it is installed and maintained properly. However, it requires a soil type that drains well.

On the other hand, if the water doesn't perc fast enough, you'll need a different type of system—most likely what's known as an aerobic septic system. The aerobic system relies on a different type of bacteria to dispose of the waste, which requires oxygen. This system has pumps and filters and requires more maintenance than the old-school system, but it's also more reliable in poorly draining soil, and is more tolerant of drainage issues or rain-saturated soil. It's also more expensive.

If you've found the land on which you want to build your dream home and haven't yet made an offer, you can make your offer contingent upon certain results of a perc test. That way, you'll know what type of system you need before you buy the land, and maybe you can negotiate the price down a little bit to help pay for a more expensive septic system.

Of course, if you don't end up buying the land, you'll be out the cost of the perc test (maybe a couple hundred bucks), but that's a small investment compared to the value of your dream.

I once built a home for a family on land they bought near Norman, Oklahoma, and they hadn't done any research into the requirements for a septic system. They assumed the standard, old-school system would be fine. As it turned out, not only did they need an aerobic system, but the combination of house size, occupancy, and soil type meant they needed a system that cost almost double what they had budgeted.

I once built a home for a family on land they bought near Norman, Oklahoma, and they hadn't done any research into the requirements for a septic system. They assumed the standard, old-school system would be fine. As it turned out, not only did they need an aerobic system, but the combination of house size, occupancy, and soil type meant they needed a system that cost almost double what they had budgeted.

Another great source of info on what type of system might be needed on a particular piece of land (if you're in Oklahoma) is the Oklahoma Department of Environmental Quality. That is the state agency responsible for regulating waste water (among other things). They have the final say in what type of system is approved for your land, so calling them is a simple way to research the issue. Here's a link to the Oklahoma DEQ web page on septic systems.

Researching the septic system requirement is only one component in your evaluation of land. You can read more articles on the subject of buying land here.

If you've ever researched the real estate market or purchased a house, you're probably familiar with the three things most important in real estate: location, location, location. Location affects the price of homes, the number of homes available, and how quickly they sell.

The same mantra of location, location, location is true when you're building a custom home on your land and applying for a construction loan.

The total amount of your construction loan hinges on the appraised value of your not-yet-built home. And that appraised value depends heavily on recent comparable sales of existing homes in the same general area. If the values of recent home sales in the area are low, the lender can't justify the cost to build a new home based on nearby property values. We've seen that happen when the nearby houses are old, small, or built with inexpensive finishes.

One of our recent clients wanted to build a smaller home but still a very nice home. When we worked through the design process, she selected a lot of higher-end features for the home. She also wanted large covered porches and patios, which add cost to build but don't count as square footage included in the appraisal. Another feature that again costs more and doesn't get included in the appraisal was the large detached garage and shop.

One of our recent clients wanted to build a smaller home but still a very nice home. When we worked through the design process, she selected a lot of higher-end features for the home. She also wanted large covered porches and patios, which add cost to build but don't count as square footage included in the appraisal. Another feature that again costs more and doesn't get included in the appraisal was the large detached garage and shop.

All of the recent home sales in the area were older, smaller homes. They didn't sell for a high enough price to justify the investment this client needs to build the home she wants on the land she already owned.

Now, that doesn't mean she can't build her home where she wants. But it does mean more of the cost will be coming out of her pocket because she can't get approved for a construction loan to cover the full cost to build.

Be sure to consider the value of nearby homes when you're deciding where to build. Comparable sales, even if they're not quite comparable in size or features, will determine how much the bank will allow for your construction loan. If you're looking for land, check out the recent sale prices of homes nearby before you decide to buy that land.

This is just one of many factors that affect financing for your custom home, so be sure to read our other financing articles so you're prepared for every possibility.

You could pick the flattest, best-draining, easiest-to-develop lot in Oklahoma, and there could still be surprises lurking in your home building project. The key is to know what you want and need, but have realistic expectations and always consult with professionals before setting your heart on something that may turn out to be impossible.

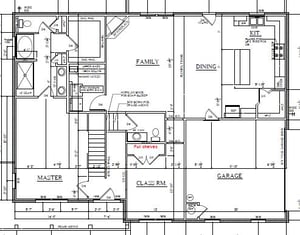

For some people building a custom home, it's tempting to try and take the DIY approach to part of the process in an effort to save money. After all, it’s your house, right? When it comes to your house plan, though, it's really best to leave it to the professionals.

There are a lot of "gotchas" in designing a house plan that won't be readily apparent until it's built. A professional home designer has designed hundreds of homes and seen the houses that she has designed actually built. She's learned from that experience over time, and she brings all of that knowledge to work with her when designing your house plan.

Still, over the years I've seen a lot of DIY house plans. Here are just a few of the problems I've seen:

Still, over the years I've seen a lot of DIY house plans. Here are just a few of the problems I've seen:

-A second floor that didn't actually fit under the roof. The stairs had less than four feet of headroom at the top, and the slope of the roof didn't allow for more than a seven-foot ceiling upstairs.

-A master bathroom toilet that was visible from the entry.

-The guest bedroom and master bedroom had direct line of sight from one bed to the other if the doors were open. Awkward.

-A bathroom where you had to step over the toilet to get in the shower.

-An entryway where the front door hit the stairs.

-A bedroom with no exterior wall, so no window in the room. That's a huge violation of building codes pretty much everywhere.

If a builder or professional home designer created any of these problems in your home, you would probably be pretty upset about them. But because of their experience in their field, they know how to avoid these problems from the very start of the design process.

Emily came to us with a house plan she created herself. It had everything she had been dreaming about, and now she just needed to find a builder who could build it within her budget. We weren't the first builder she had interviewed, and we weren't the last.

I think she kept shopping around because she hadn't yet found a builder who could build it within her budget. In her mind, she was committed to this house plan and wasn't going to stop until she got the answer she wanted to hear. Unfortunately, we gave her the same answer she had heard many times: this house plan is outside your budget.

Several months later, Emily returned. She had come to realize that the house plan she had created couldn't be built in its current form within her budget. But by working with a professional house plan designer, Emily was able to craft a house plan that would not only satisfy her wants and needs, but also fit within her budget.

What went wrong on her original plan to design it herself? Emily figured that since there are many inexpensive house design software programs out there, it must be pretty easy to draw your own house plan. But having the right tool is only part of the equation.

There are lots of considerations when designing a house plan: traffic flow, room dimensions, door swings, sight lines, ceiling heights, etc. It’s a job that’s usually too much for someone without professional training and experience.

There are also constraints to laying out the perimeter that are hard to manage without some experience visualizing the outcome. In particular, there's the layout and shape of the roof. If you aren't careful with the layout of the walls, you can end up with roof planes that intersect in a horizontal valley (called a "dead valley") that will cause the roof to leak. Or you can end up with parts of the house that can't be covered with a conventional roof because of how the sections intersect. It can end up requiring multiple roof slopes, which can quickly look really weird and cost a lot of money.

Another roof design problem happens with two-story houses that don't allow adequate clearance for the stairs or some upstairs rooms. Ever been in a second-story room where you had to duck your head? As a builder, I've had to correct house plans where the roof, as drawn by the designer, didn't allow enough headroom over the stairs. At that point, it added to the cost of the house, but a slight design change from the beginning could have solved the problem without adding cost.

Another roof design problem happens with two-story houses that don't allow adequate clearance for the stairs or some upstairs rooms. Ever been in a second-story room where you had to duck your head? As a builder, I've had to correct house plans where the roof, as drawn by the designer, didn't allow enough headroom over the stairs. At that point, it added to the cost of the house, but a slight design change from the beginning could have solved the problem without adding cost.

There are other certain design principles to follow that make the house cost-efficient to build. The more times the perimeter of the house turns a corner, the more complex the walls, foundation, and roof systems become. Every turn of a corner creates waste, which increases the cost without adding any value.

For example, think about a square that's ten square feet. Now, think about the same square with a notch cut out of every corner. Expand the square so that it's ten square feet again, and you have two squares of the same size, but one has four corners while the other has twelve. If you were going to put a roof over that one with twelve corners, do you think it would be more difficult to do and more expensive? Absolutely!

Hallways cost money, too. Yes, they count as living space and count in the square footage of your home, but hallways either reduce the size of the rooms you can afford or add to the total cost of the house without adding value.

Good house designers work hard to lay out rooms efficiently while keeping traffic flow in mind to reduce or eliminate hallways.

Designing a house is just like anything else—it takes practice and experience to get good at it. Unless you want to be your own guinea pig, it's best to let professional who has already learned all the hard lessons from past experiences design your home. They can make it fit your needs, wants, and budget. And it could save you tens of thousands of dollars.

Once you find a professional home designer you trust, it’s time to start discussing what your family’s needs and wants are and reviewing plans that fit your vision. Your builder will probably have many options to look at as you identify what you want and what is possible on your lot.

However, one of the most frustrating parts of looking at house plans online, in a plan book, in a magazine, or wherever, is that looking at a house plan on a flat screen or piece of paper won’t tell you how the house is going to look or feel in real life. You might love the way a plan is laid out or how the front elevation looks, but you probably still have nagging questions.

Is that family room big enough for my furniture? Is that dining room really big enough for our dinner table and chairs? Will the kids be able to fit all their stuff in that bedroom? Will my truck fit into that garage along with the mower and the four-wheeler?

These are all legitimate questions. While you might not ever get to see that online house plan in real life, there are some ways to answer some of those nagging questions by doing a little homework.

Here’s how to determine if the house plans you like will fit your family.

Gather up a few items: a pencil (not a pen), a pad of paper, a tape measure, and a ruler. Take a couple of Sunday afternoons and find some open houses in neighborhoods that seem to be in your price range. Walk through those houses with the purpose of building a sense of room sizes and overall scale. You might get some weird looks from the realtors and other people touring the homes, but sometimes that just adds to the fun.

Gather up a few items: a pencil (not a pen), a pad of paper, a tape measure, and a ruler. Take a couple of Sunday afternoons and find some open houses in neighborhoods that seem to be in your price range. Walk through those houses with the purpose of building a sense of room sizes and overall scale. You might get some weird looks from the realtors and other people touring the homes, but sometimes that just adds to the fun.

Measure family rooms, dining rooms, bedrooms, kitchens, garages, and whatever else is important to you. Write down the dimensions. Using your ruler, sketch the rooms on your paper using a scale that will allow you to draw the rooms proportionally. I like to use one-quarter inch on the ruler to represent one foot in real life, if I can get the dimension to fit on the paper—otherwise, shrink it to one-eighth inch per foot.

Pull out those house plans you like and compare what you saw in real life to the rooms in the house plans. By doing this, you'll get a feel for what those dimensions on the house plans look like in real life.

I once built a home for a family who had chosen a house plan from a book and really liked the way the home would look from the front. In fact, they fell in love with it. One room that was critical to them was the dining room—they enjoyed hosting extended family for holidays and other occasions and wanted to share their table with everyone, something they couldn't do in their old house.

When visiting open houses and measuring their proposed dining table at the furniture store (with people seated around it) they realized the dining room in their dream house plan wasn't big enough. Since making rooms bigger is much easier on paper than in real life, we helped them modify the house plan and create the space they needed to preserve the look they had fallen in love with.

By doing their homework, they discovered the fatal flaw and were able to correct it.

If you're ready for more detail, read this comprehensive article on how to find the perfect house plan.

There are lots of ways to visualize what a house plan is going to look and feel like in real life. There are also lots of possibilities when designing a plan from scratch. The key is to get a feel for scale by training yourself to mentally translate the flat floor plan into real life through real-world examples.

We recently worked with a couple with two teenagers. They're building their forever home on the ideal piece of ground, and they're looking forward to growing old there. The best feature of the land will be the view out the back windows of the house.

They want their kids to enjoy that view while living there the next four to six years, and then they want to continue to enjoy that view themselves.

Considering their design requirements and their budget, they were struggling with how to design the upstairs with that flexibility in mind.

They wanted bedrooms and a game room with a view that could later be a space for mom, dad, and their friends, but there wasn't enough room upstairs to make that happen.

After much discussion, head scratching, and sketching out ideas, we decided the kids' view from their bedrooms wasn't really the most important thing.

After much discussion, head scratching, and sketching out ideas, we decided the kids' view from their bedrooms wasn't really the most important thing.

After all, they'll be sleeping in those rooms, and most of their daytime activity will happen in the game room. They elected to move the bedrooms to the side and put the game room in the back so it would have the view.

By doing that, we were even able to put in a small balcony. Now they can enjoy the awesome view from the game room windows or head out on the deck and enjoy the view from outside with a high vantage point.

By thinking through both the current and future uses of the house and the rooms, this family was able to design a forever home that will be fantastic now and flexible enough to be fantastic well into the future as their family and lifestyle changes.

As the family in the story above recognized, the needs of your family will change over time and it’s important to take that into consideration when designing your forever home. Here are a few other things to consider depending on your situation as you start designing your dream home.

If you're planning to live in your home for a long time or there's a possibility of aging parents living with you, it's important to think about accessibility.

-Should you make the doors wider to accommodate a walker or wheelchair?

-Do you need to design a second living space that can easily convert to guest quarters later?

-Or perhaps you need guest quarters now that can transition to living space later?

That impacts decisions about the location of bathrooms, the width of doors, and where you put walls.

If you plan to stay in the house after the kids are gone, you might think about designing a two-story home with a dual purpose. Put all the kids' bedrooms upstairs and keep the downstairs relatively small. That lets you get the most square footage for the dollar, plus you can "shut down" the upstairs (half the house) after the kids are gone to save money on utilities.

When you're building a forever home, there are lots of aspects of your future life to consider that you can incorporate into a flexible house plan.

Your builder can help you think through those things and how to accommodate them with a flexible house plan that fits your budget. It will take some patience and creativity, but it will be worth it in the end.

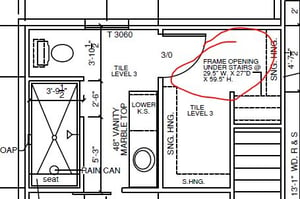

One of the perks of a custom home is you can include special features that fit your lifestyle and interests that may not fit in a standard house. While we’re going to speak specifically about gun safes here, these same principles of creativity and function could apply to other large furnishings, equipment, or fixtures as well.

For families with guns in their home, a gun safe is a necessary safety component to include in the home. But they're big, heavy, and awkward. Plus, you generally want your gun safe to be hidden. So where do you put it?

One client of ours had lived in several houses before building their custom home. In one home, they wanted to put the gun safe in the master bedroom closet, but it wouldn't fit through the door. And even if it had, it simply took up too much of the closet space.

When you can't fit the gun safe in a conveniently tucked away spot in the house, it may end up sitting along the wall in a room. It may still be hidden from most guests in your home, but it's not really hidden from kids or any service providers in your home. And, most gun safes don't exactly classify as decorative furniture either (although some certainly can).

When you can't fit the gun safe in a conveniently tucked away spot in the house, it may end up sitting along the wall in a room. It may still be hidden from most guests in your home, but it's not really hidden from kids or any service providers in your home. And, most gun safes don't exactly classify as decorative furniture either (although some certainly can).

When this client designed their custom house plan, they created a space specifically for the gun safe. It had exactly the right dimensions and made use of an otherwise unusable space. They designed the gun safe nook in the master closet, which was tucked under the stairs of the house. All doorways into the bedroom and closet were wide enough for both the gun safe and the two-wheel dolly required to move it.

Once the gun safe was moved into its spot, it was hidden from view but still easily accessible by the owners of the home. It was the perfect solution!

Of course, design creativity like this isn't limited to just gun safes. It can apply to any big, awkward pieces of furniture. Maybe that's vault storage for valuables in a home office or even just a custom closet large enough to store holiday decorations.

When it comes to a custom home, there are plenty of options to make the little and big things work for your family.

Maybe you don’t need a gun safe built into your new home, but most families have some sort of features that are important enough to them that they are building a custom house to ensure those features are incorporated. Here’s some further information about features some Oklahoma families want in their homes and whether you can get them and stay within budget.

Basements aren't common in Oklahoma. And the reason why is because basements aren't common in Oklahoma.

I know that's not really an answer, but believe it or not, that's part of it. I often talk to people who wonder why it's so expensive and rare to build a basement in Oklahoma. Here's my perspective on it, as a builder.

But first, let's dispel the myth that a basement makes a good tornado shelter. Unless it has a reinforced concrete roof, a basement won't substitute for a tornado shelter. If your basement has a typical wood-framed floor above it, anything heavy that a tornado drops in your house will come right through that basement ceiling.

That said, here are a couple of reasons why you don't find a lot of basements in Oklahoma.

Here in central Oklahoma, we don't have to dig too deep to make sure a home's foundation won't freeze in the winter. Home foundations need to be dug deep enough that they are below winter frost, and in our part of the world, that's only about 18 inches.

Here in central Oklahoma, we don't have to dig too deep to make sure a home's foundation won't freeze in the winter. Home foundations need to be dug deep enough that they are below winter frost, and in our part of the world, that's only about 18 inches.

Travel north to Wichita, for example, and you'll find you have to dig twice as deep to avoid the frost. If you're already excavating 3 or 4 feet of dirt just to make the foundation safe, you might as well go another 4 feet down and build yourself a basement.

We don't have to automatically dig out half the height of a room in order to lay foundation, so it's much less cost-effective to build a basement here than in Wichita.

Speaking of cost—the market in Wichita has come to expect a basement under every home, so there are plenty of contractors who can build them. When something is as common as, well, dirt, it becomes inexpensive.

The Oklahoma market isn't like that. There's generally a low demand for basements in our market, so there are very few contractors who can build basements. The contractors who are able to build basements can charge more because there are fewer of them.

A basement will add square footage to your house, but at a very high cost. It's a lot less expensive in Oklahoma to build out or up than down, because our soil doesn't require deep foundations and we don't have a lot of contractors who can build basements.

It's kind of a vicious cycle - because there's not much supply, nobody expects a basement, so if you're planning to build a new house on your land, you won't find many builders with house plans designed specifically for a basement. Don’t say I didn’t warn you.

Surely it has to cost a lot more to build a custom home that will be wheelchair accessible, or can accommodate future aging needs, right?

I get that question a lot. I can't speak for other builders, but we certainly don't think that should be the case. Does a three-foot wide door cost more than a two-and-a-half foot door? A little—but we're talking maybe $20 more. If that's something that's planned into your home build and not added later, there's no reason an accessible home should bust your budget.

I get that question a lot. I can't speak for other builders, but we certainly don't think that should be the case. Does a three-foot wide door cost more than a two-and-a-half foot door? A little—but we're talking maybe $20 more. If that's something that's planned into your home build and not added later, there's no reason an accessible home should bust your budget.

Price shouldn't be an issue when you're considering building a home that will meet your future needs as well as it meets your current ones. It's an issue of how to build an accessible home affordably, not whether or not it can be done.

To do that, it takes creative, disciplined design work. So before you plan to build a home on your land, think about your future needs. How long will you live there? Will you host aging parents for weekly dinner or take care of them in their later years? Do you have a disabled family member? Do you just have bad knees?

These are all things to think about and incorporate into your home design.

If you do it up front, there's no reason your accessible home should inherently cost more to build than one that isn't.

We have a couple examples of accessible homes featured in our Homes We’ve Built page: the Captain's home and the Montgomery Drive home. Both of these homes have various accessible design features. The home designer used efficient and effective design techniques to keep the building costs down so the houses would remain affordable.

You have a better idea of your home's future needs than your builder does! Make sure you communicate those needs to them so they can plan an efficient, affordable home build.

And don't give in to the idea that an accessible home design has to break the bank. That's simply not the case.

Accessible home designs are something that is near and dear to our hearts. Turner and Son Homes has partnered with the Oklahoma Family Network as the home builder of choice for ADA accessible homes. Two of our executives, Jerry and Athena Captain, have a daughter with special needs they care for full time.

Athena is on the board at OFN which is an organization that provides resources and mentorship for families in the state of Oklahoma dealing with children with special needs through emotional support, resource navigation and ensuring quality healthcare.

OFN promotes family-centered care and provides tools so families and individuals can make informed decisions, advocate for improved services, build partnerships among professionals and families, and serve as a trusted resource on health care of children and young adults and family/professional partnerships.

Families who have children with special needs have unique struggles and stresses. They struggle with enormous medical debt while also juggling therapy appointments and doctor visits. In the case of Athena and Jerry, their daughter Savannah has 16 specialists, not including occupational, physical or speech therapy. These frequent appointments have to be managed by the family along with state paperwork that keeps the child eligible for any and all services. Every family outing requires more planning and preparation than most of us could ever imagine.

The Captains aren't unusual in their needs. Most families who have a child with special needs don't have the mental capacity, time or energy to manage a major project like building a home and ensuring it's built with their child's special needs in mind. That is a huge amount of time and resources that takes for me to do that. If they're going to build a home, they need a builder who is going to understand what they're going through, help build a house that's as affordable as possible, and not create more stress and drama in their life.

The Captains aren't unusual in their needs. Most families who have a child with special needs don't have the mental capacity, time or energy to manage a major project like building a home and ensuring it's built with their child's special needs in mind. That is a huge amount of time and resources that takes for me to do that. If they're going to build a home, they need a builder who is going to understand what they're going through, help build a house that's as affordable as possible, and not create more stress and drama in their life.

There's a lot of pain associated with raising a child with special needs. OFN has an entire statewide membership group who feel that pain. Turner and Son have proven their ability to be trusted with building quality ADA accessible homes within budget and hassle free. That trust has now translated into a partnership we'll carry far into the future.

If you know anyone who could use the support of the Oklahoma Family Network, we encourage you to visit their website. And if you or anyone you know needs a custom built ADA accessible home within a budget, please give us a call at 405-285-2856.

Hi, I'm Athena Davis-Captain. I am Vice President of Sales & Marketing for Turner & Son Homes and Red Door Homes. I am breaking ground on a new home for my daughter, Savannah.

This will not be an ordinary home - Savannah's dream home will provide her with a new level of independence. This is Savannah's story - follow along as I share building an incredible home for an incredible girl.

https://www.youtube.com/watch?v=PoeOUjUkie4

So you’ve found a great piece of land for sale, you have the perfect house plans drawn up, and you’re raring to go. But not so fast. So far everything you have planned is still a dream until you pay for it.

Think you know how to pay for a custom built house? Not so fast. It’s not quite the same as mortgaging a ready-made home. Keep reading to learn about construction loans and some tips for getting approved for one.

Paying for a house that's being built on your land is very different from buying a new house from a builder, or even buying a custom home on the lot a builder owns. To build a custom home on your land, you'll need a construction loan.

A construction loan is different from a permanent loan (usually called a "mortgage") in several ways:

-A construction loan comes from a bank, not a mortgage company;

-A construction loan is short-term, meaning you'll pay it back in usually less than a year (more on how this works later);

-Usually, you pay only the interest on the loan during construction, rather than paying principal plus interest (this is nice because you won't be making a traditional house payment for that period);

-A bank will want a bigger down payment, as much as 20% of the appraised value of the home to be built.

-A bank will want a lower debt-to-income ratio, which is simply the amount of your current debt payments divided by your income.

You'll apply for the construction loan after you've been pre-approved for a mortgage, because of the way the construction loan gets paid off. The bank wants to know that you'll be able to get the permanent loan (mortgage) when the house is done, because that permanent loan is what pays off the construction loan.

Once you're approved for the construction loan, the bank will order an appraisal, which is a professional opinion of the market value of the new house you're planning to build. There are many factors that affect the appraised value, some of which are:

-Location of the land;

-Size of the house;

-Amenities and features of the house;

-Recent sales in the surrounding area.

If the appraised value ends up higher than what you're actually spending on the house, which happens frequently, the bank might actually reduce the amount of cash down payment you need. The reason is they usually use a formula to figure out how much your loan will be that looks like this:

Loan Amount = Appraised Value X 80%

As you can see, the amount you're actually paying for the house doesn't figure in this equation. So, if the appraised value is $200K, the bank will lend you $160K. If your house is only going to cost $190K, then that leaves you with $30K to come up with in cash.

After the appraisal is done, and the title to the land has been checked, you'll close on your construction loan and be ready to start building.

Great question. You'll pay your builder in installments, commonly called draws, which correspond roughly to specific phases of construction. This process varies widely. In principle, this is how it works: the builder completes a phase (let's say the foundation, under-slab plumbing, and the concrete slab); you pay a certain percentage of the total price. Each time the builder completes a phase, you pay an agreed-upon percentage of the total, until the house is 100% complete.

Once you've paid the builder 100% of the total, you'll start the process of closing on the permanent loan, or mortgage. From the perspective of the mortgage company, this isn't a new home purchase, it is a refinancing of an existing loan (the construction loan). Basically, you're taking out a new loan that pays off the existing construction loan.

That's the process in a nutshell. For more information on financing a custom home, please check out our blog summary page on the financing topic.

While we’re on the subject of the builder, let’s look at what he or she will cost you.

While we’re on the subject of the builder, let’s look at what he or she will cost you.

Of course you want to get the most for your money when building a house. And you know the builder will make a profit. The question is, how much does the builder make? I'll give you a little peek behind that curtain...

The short answer: 10-20% of the total price you pay. A good builder will earn his profit (on a $250,000, figure $25,000 - $50,000), by saving you more money— in reduced waste, time, and aggravation— than you will pay him in profit. Additionally, you're getting the builder's expertise in land selection and preparation, house plan design, financing, and any other area related to building a home on your land.

Maybe you're thinking, “I can do all that stuff a builder does myself,” reducing the cost to build a house. And it makes sense, in theory.

But consider this: On the first day you arrived at your current job, did you know what to do without making a mistake? Could your boss replace you with someone off the street, pay them half the money (or pay them nothing), and get the same results?

There are many factors that go into the cost to build a house, including labor, materials, the builder's overhead and profit, and waste. You need the labor and materials. You DON'T want the waste, even though some is unavoidable. Do you need to pay a builder for his overhead and profit? It depends on whether you respect a particular builder's abilities and expertise.

You might be thinking, “Holy cow, I'm going to pay a builder somewhere near $30,000 just to make some phone calls and set up a schedule? No way! I can do that myself.” Maybe you can, but if you believe that, you'd have to believe that anyone could enter YOUR workplace and do it as well as you do without any prior experience.

Of course, there's a lot more to it that just some phones calls and setting up a schedule. There's all the planning (like where is the heat and air system going to go with all these rafter braces in the way?), material specifying (should that ceiling be 2x6s, 2x8s, or what?), estimating, ordering, purchasing, making sure all the materials get delivered correctly, making sure the contractors do their work according to code, etc…

I know there's a lot of distrust built up against custom home builders (much of it warranted), but it's unlikely that someone with no building experience will be able to build a house smoothly without expensive mistakes. In one stroke of a pen, you can make an $8,000 mistake like approving the wrong cabinet material.

I know there's a lot of distrust built up against custom home builders (much of it warranted), but it's unlikely that someone with no building experience will be able to build a house smoothly without expensive mistakes. In one stroke of a pen, you can make an $8,000 mistake like approving the wrong cabinet material.

You have to decide whether among the builders available to you, there's one who can save you more in money, time, and wasted energy than he makes in profit. After all, that's your value to your employer too - you have to add more to the bottom line than your boss pays you, or else why are you on the payroll?

If you're still thinking that hiring a builder to build your custom home is a possibility, it's worth looking at the two main types of building projects (or contracts) and how each one affects how much you'll pay the builder.

"Cost-plus" building means that you pay the actual cost of the construction, plus a fee (usually a percentage of the cost) to the builder as his fee. The great thing about this arrangement is that you, the customer, know EXACTLY how much money you're paying the builder, and how much money is going to pay for material and labor. The fee is widely variable, but based on what my fellow builders charge (the ones I trust to tell me the truth), it's typically 15-20%.

In this case, you have total freedom before and during the build to change anything you want, at any time.

As long as you can afford the expense of making the changes, there's nothing to stop you, since you've agreed to pay the cost of construction, whatever it is.

The builder doesn't mind, because he's just managing the work and you're paying the bills, and he doesn't have to worry if he's priced a change high enough to make a reasonable profit (and not lose money).

The downside is that the cost of mistakes, omissions, and lack of planning are on you. You're responsible for material overages, increase in material and labor prices, and whatever other expensive mistakes crop up during your home build. You also pay the builder's fee on top of that, and the fee actually goes up when there are more expensive mistakes in the home build.

Assuming all things are equal, and you can do all the planning, specifying of materials, budgeting, supervising, and negotiating with the same expertise as a builder who has built dozens, or hundreds, of homes, then building your own house will save you that 10-15%.

The other main type of home building contract is "fixed-price," which means that the builder plans out every detail of your home ahead of time, tells you how much it is, and is responsible for the cost of mistakes.

There is profit in the fixed-price contract, of course, or else the builder wouldn't still be in business. There's a wider range in the fixed-price contract simply because the builder absorbs all the variation from the original estimate. It's in the range of 10-25%, according to numbers from the National Association of Homebuilders (NAHB). Since the profit margin decreases any time there are expensive mistakes, the builder is more motivated than you are to keep those mistakes to a minimum.

Doesn't that tempt the fixed-price builder to cut corners if there's a problem? Possibly, and that becomes easy to do if you don't have an extremely detailed list of specifications he agreed to follow.

Your home should be defined down to the last doorknob, so you know whether your home is built as promised.

The good fixed-price builder has control processes in place, developed over the course of many years of building homes, which is why he has the confidence to give you a fixed price. He knows what he can do and what he can't do. The bad one is winging it anyway, with no idea how much he'll make until it's done. His original price was a guess, so he doesn't have anything to compare the final number to.

The good fixed-price builder can build your home for less money, even with his profit, than you could yourself, because of the systems and techniques he's refined over the years. And the close relationships he has with suppliers and contractors can also help you keep costs down. The bad one can't, but you don't want him anyway.

Now you know how much a builder makes. The good ones earn it, and unlike your savings account, you will actually make a return on that investment.

Let’s bring the discussion of construction loans and builders full circle. Many people looking for a construction loan to build a house on their own land find it difficult to find a bank that will do it. Banks are extremely cautious about construction lending, depending on the builder involved.

Why is that?

Incomplete projects are all too common within the construction business. It's risky for banks to approve construction loans. There are three main reasons some builders are viewed as much less risky than others.

New builders don't have a track record long enough for many bankers to feel confident they can get the project done on time and within budget. A builder who is well-known in the community and has a good reputation among the banks can expedite the loan approval process.

When a builder signs a contract with a client for a set dollar amount, that's the price the client can expect to pay. If the price of lumber increases by 40% after the contract is signed, the builder eats that cost, ensuring the client's budget stays the same.

When a builder signs a contract with a client for a set dollar amount, that's the price the client can expect to pay. If the price of lumber increases by 40% after the contract is signed, the builder eats that cost, ensuring the client's budget stays the same.

Price increases for building materials is more common that you might think! Prices are constantly changing. If you go to a cost plus builder, the price you agree upon could change depending on what price increases the build incurs in materials during the building process.

Bankers fear the cost of the building project going up, because that increases the amount they'll have to lend, and increases the chance they'll end up with a non-performing loan on their books.

A builder who is cost effective in his or her building process will find that the homes he/she builds appraise for more than the contract price. The client gets an immediate return on her investment. Banks love it when the appraisal price is more than the cost to build because it takes even more risk off of them. The higher the appraised value compared to the actual price the client pays, the less likely there is to be a problem when it comes time to do the permanent mortgage.

It all comes down to what kind of reputation a builder has for getting things done.

If he or she has a great record in your area of completing projects on time and under budget, local banks will be glad to lend you money for your project. When looking for a builder, it helps to have one who has a solid, successful history and strong ties in the community.

A business' success has everything to do with its customers, and a company like Turner & Son doesn't operate as long as it has without the support of the local community.

We appreciate the support we've been given and do our best to give back whenever possible and find specific areas where we can help the most.

When it comes to home building, that means focusing on more than just building homes for the sake of money and it's one of the reasons we're working with the Oklahoma Family Network (OFN) to build customized homes suited for children and young adults with disabilities.

If you've never heard of OFN, they're a fantastic organization that focuses on supporting families of children with special needs – emotional, mental, and physical. They provide connections to parent-to-parent support groups as well financial, childcare, healthcare, and educational resources.

In short, they support Oklahoma families faced with the unique challenges of raising a child with special needs.

This is a community that is significantly underserved and often struggles to find advice and general assistance without working through a frustrating maze of information.

One of the challenges that OFN families face is living in homes that don't support the growth and development of their child. Even simple tasks like moving between rooms and taking a shower are more difficult than they should be in standard homes.

One of the challenges that OFN families face is living in homes that don't support the growth and development of their child. Even simple tasks like moving between rooms and taking a shower are more difficult than they should be in standard homes.

Most builders have limited knowledge of ADA standards and home features. Generally, ADA-friendly home building begins and ends with concrete entry ramps.

We've worked to become experts at building ADA-friendly homes and become a resource to the OFN and their families. Instead of retrofitting homes to only partly meet a family's need, we design our ADA-friendly homes to be accessible from the start, with features like extra-wide hallways, pocket doors, and seamless floor transitions.

Obviously, we're big fans of the OFN and support their mission and programs. If you're interested in joining us in support of their organization there are a number of opportunities to get involved including volunteer work and donations.

Now that you’ve figured out the process for paying for a custom home, it’s time to jump in. But I don’t mean jump into building yet. You can’t build without money, and you probably won’t have the money without a bank. Now begins the process of picking a bank who will hopefully approve you for the construction loan.

Having dealt with many banks over the years, I thought I would pass along some wisdom about finding the right bank for your construction loan. This wisdom actually comes to me from a banker I've worked with for years, whose judgement and industry knowledge I trust.

Let’s start at the beginning.

Let’s start at the beginning.

Every business needs a sales force, as they are the ones who find the clients. Without clients, we all know what happens to a business. At a bank, the salesperson is called a loan officer, and it's their job is to drum up business for the bank.

The loan officer sits down to meet with you and tells you about all the great options they have for loans. They give you an application, ask you to bring in all your supporting documents, and make it sound pretty positive at that first meeting.

But the loan officer doesn't really get to decide—that's up to the underwriter. They're the ones who will look at your file and decide whether or not to make a loan.

Like any other organization in a broader industry, banks have niches. As a home builder, we have relationships with several banks whose niche is doing construction loans for builders and for individuals.

When meeting with different banks, be sure you ask detailed probing questions. Don't be intimidated by the fact that you aren't well-versed in construction loans—nobody but the banker is. Keep in mind that the banker isn't well-versed in whatever you do for a living either.

I suggest asking any bank you approach what their experience is with construction loans. If they haven’t granted many and aren’t prepared to tell you their process for construction loans, this obviously isn’t their specialty. Construction loans aren’t like mortgages, so you want to work with someone who knows what they’re doing.

When you’ve found a bank who does construction loans, there’s a few more things to consider just to make sure all your bases are covered. You may have other questions of your own, but here are two I think you should ask any banker and why you should ask them.

If the answer is yes, the bank may be limited in the total dollar amount of loans they can make for homes built on rural land. It's an overall limit for the bank, not necessarily a limit on the amount of an individual house.

That means the loan officer who is offering that great deal (low rate, low closing costs, whatever) might not be able to actually make you that loan.

By asking this question and telling the banker why you're asking, you might save yourself a couple of weeks. You can find out if you're going to get a "no" right away rather than having to wait two weeks and hassle with all the paperwork.

Often times, a banker might suggest he or she can lend you 95% or even 100% of the appraised value of the home on a construction loan. Sounds like a great deal, right? That means you might not have to be out any cash at all (or very little).

Often times, a banker might suggest he or she can lend you 95% or even 100% of the appraised value of the home on a construction loan. Sounds like a great deal, right? That means you might not have to be out any cash at all (or very little).

The deal is valid, but it might have several contingencies attached. For example, it might require that you own your land or have owned it for some time. That means if you intend to buy the land with proceeds from your loan, you won't get the high loan-to-value (LTV) that brought you into the bank in the first place.

If the high LTV is what attracted you and you aren't a good fit for that particular loan program, another bank might be a better fit for your situation. You don't have to stay with the first bank you talk to! Explore your options and find one that's a good fit.

It may take some time to find a bank you can successfully work with, but you want to make sure you find a bank that's the right fit for your particular situation. If you’re struggling, your builder can help you with that, as he probably has many banking relationships and can introduce you to just the right one.

I’ll warn you now, the construction loan process is often one of the most challenging aspects of building a home on your land. It can be a frustrating process, but understanding why it takes so long can help ease some of the frustration. Here are two main reasons it takes so long to get approved for a construction loan.

The housing crisis in 2008 resulted in lots of new federal regulations. Those regulations are designed to help protect the people borrowing money and hold the banks accountable to the decisions they make.

Banks want to make sure they're covering everything, which can lead to them being overly cautious. And when they're extra cautious, they're also slow. Especially when the rules are constantly changing.

There are checks, double checks, and triple checks to make sure everything is right and in line with regulations at every step of the process.

One example is the fees the bank quotes you. They have to match the final numbers exactly. You as the customer have three days to review the final numbers. If there's a mistake, they take the time to correct the mistake plus give you another three days to review the final numbers.

There's a hidden, but not secret, process at every bank when it comes to loaning you money. The loan officer that you meet with is more accurately the loan salesperson. They don't really have the authority to make decisions—they're simply guiding you through the process.

You give all of your information to the loan officer, and they turn it all over to the underwriter, or the "man behind the curtain." The underwriter scrutinizes all of your info and compares your financial situation to a checklist of bank and federal requirements. If they see something that's not typical or if a little more information will help you qualify for the loan, they'll call the loan officer to request that info.

Then the loan officer calls you to request the additional information the underwriter needs. You may be thinking, "Why didn't you just ask for that information up front?" The reason is the loan officer doesn't know what information will be needed. The underwriter doesn't know every piece of detail needed either until they start reviewing your information. It's a process, and it takes time.

While complying with all the federal regulations and waiting on the bank's hidden process can make it seem like the loan process takes forever, it's a necessary process. The checks and balances in place help ensure you get a loan you can afford that meets all the requirements of the bank and government regulations.

Yes, it's frustrating and seems disorganized, but it's actually a well-define process. Be patient and know they're working on it.

Over the last 53 years building homes in central Oklahoma, we've done business with dozens of banks. Some have been excellent to deal with, from both the builder and customer perspectives, some have been OK, and some have been downright difficult if not incompetent. Since getting a construction loan to build a new house is a key element of building a home on your land, whether it's in Oklahoma or somewhere else, I thought it would be helpful to share what I've learned.

Over the last 53 years building homes in central Oklahoma, we've done business with dozens of banks. Some have been excellent to deal with, from both the builder and customer perspectives, some have been OK, and some have been downright difficult if not incompetent. Since getting a construction loan to build a new house is a key element of building a home on your land, whether it's in Oklahoma or somewhere else, I thought it would be helpful to share what I've learned.

Construction loans for building a home are different from other types of loans. Many bankers will tell you they'll do a loan to build a new home, but not that many are actually good at it. You can ask the banker what title company they use, if they have a list of preferred appraisers, and who does the progress inspections... If they can't give you a ready answer, they might not really be that good at construction lending, and using a bank like that will lead to delays and frustration.

The best banks in Oklahoma City for construction loans will be the ones that have a dedicated team for just that purpose.

Oh, and please don't use interest rate as your guiding principle. There are so many other factors, and there won't be much difference in rates anyway. When you calculate the actual dollar difference, you might find you're stepping over dollars to get to pennies.

In Oklahoma City and surrounding areas, here are the top 5 construction lending banks (in my humble opinion):

1. Valor Bank. This is an old, established rural Oklahoma bank under new ownership. The new ownership consists of talented and experienced bankers looking for new opportunities, and their construction lending department is top-notch in customer service, honesty, and follow-through.

2. F&M Bank (and FMB Morgage). This is a family-owned bank with years of experience in construction lending. For years, I dealt with Chad Johnson in the Crescent branch, but they've recently re-worked their internal systems to make their customer experience even better.

3. Advantage Bank. While not a large bank, Advantage "gets it" when it comes to lending money to build. One unique element is Advantage doesn't have its own mortgage department (as of this writing), so they do business with many mortgage companies around town. This network of connections can help you if for some reason you want to separate your construction business from your mortgage business.

4. Tinker Federal Credit Union. TFCU, like others on this list, has been doing loans for customers to build new homes for years, and is very familiar with the more rural projects.

5. NBC Bank. We haven't done a great deal of business with NBC, but what we have done has been very smooth for our clients and for us. The loan officer we do business with at NBC has a deep background in construction lending from another large Oklahoma bank, so she knows what she's doing.

For more articles about construction loans, please check out these articles:

Are you getting the right construction loan?

Financing your custom home doesn't have to be scary

Home construction loans: choosing the right bank

We’ve talked a lot about the important roles your house builder will play on your custom home journey, but I don’t want to assume everyone reading this already has a builder in mind. Just like it’s important to pick the right bank, it’s important to pick the right builder. This will be the person who guides you through most of the process and actually builds your house. They are the person responsible for making your house building dreams come true.

If you haven’t found a great Oklahoma builder yet, here’s some information to help you get started in selecting the perfect one for you.

When it comes to building a new home, there are different kinds of builders. And the builder you need depends on what you're looking for in the finished product and what you're looking for in the process.

Here's an overview of the different types of builders and what to expect.

A production builder is good if you want to live in a neighborhood, you want a house built sooner rather than later, and your budget is tight. In most cases, you're also not looking for a home you plan to live in forever.

Production builders only build in developed neighborhoods. They may be the ones developing the ground or they may buy a few lots from a developer alongside other builders in the same price range. They build from several different house plans with a few standard options, but they don't customize a house plan for each customer.

Production builders only build in developed neighborhoods. They may be the ones developing the ground or they may buy a few lots from a developer alongside other builders in the same price range. They build from several different house plans with a few standard options, but they don't customize a house plan for each customer.

While there isn't a lot of flexibility in design or options, the fact that they're building the same few house plans in close proximity gives the builder an efficiency that keeps costs down. You also have the opportunity to buy existing inventory, either a completed home or one still under construction, which can save time.

If you don't want to make a bunch of decisions about your home, then a production builder is a good choice. Here are a few things to look for when searching for a good production builder:

1. Neat and tidy job sites.

2. Employees running the job sites drive clean cars or pickups (not the subcontractors working on the job, but the builder's employees).

3. Visible recent activity on the job sites rather than jobs sitting for weeks with no progress.

4. Not much building waste lying around, such as lumber, drywall scraps, or insulation.

A semi-custom builder is good if you want to live in a neighborhood or you want to live on your own land not far from town. It's also a good choice if you're not in a huge hurry and don't need a highly customized house plan, but you would like to make a few modifications to fit your need.

A semi-custom builder is good if you want to live in a neighborhood or you want to live on your own land not far from town. It's also a good choice if you're not in a huge hurry and don't need a highly customized house plan, but you would like to make a few modifications to fit your need.

This type of builder works from a portfolio of plans and will customize a house plan for each customer. They don't design from scratch, nor do they build a house from a plan the customer provides.

They'll be able to quote you a price per square foot because they know the house plans in their portfolio and have a good idea from past experience what each one will cost to build. But that means each change to the plan comes with uncertainty for the builder and added cost for you. You'll have lots of flexibility in color and material selections as long as you stay within the options they're used to providing.

With semi-custom homes, the builder might provide the construction financing, which means he will build the house and sell it to you when it's finished, or you might be asked to provide the construction loan. They might have some inventory you can view or even buy, either finished homes or some still under construction. Ask if you can walk through any existing homes in their inventory to get a feel for a particular plan.

If you're leaning toward a semi-custom home builder, here are a few things to look for as you choose a builder:

1. All the things we mentioned above in the production builder section, with the understanding that a semi-custom builder might have longer delays between construction phases. This could be because he's using a core group of contractors that know him well and do what's expected.

2. The owner of the company might be the one running the jobs, which is fine as long as he's not trying to run too many. He or she may also have a field superintendent running each job.

3. Watch out for lots of waste, as inefficient control of materials can drive up cost and increase your price.

If you own your own land, plan to buy your own land, or have very specific needs and wants in a new home, then a custom builder is right for you. They can build pretty much any house plan—one they design from scratch for you, one that combines the best of several plans you like, or one that you bring to them.

If you own your own land, plan to buy your own land, or have very specific needs and wants in a new home, then a custom builder is right for you. They can build pretty much any house plan—one they design from scratch for you, one that combines the best of several plans you like, or one that you bring to them.

Using a custom builder means lots of flexibility in design, features, and materials. The only limitations are the methods common to residential construction, such as the materials used for walls, veneer, windows, and doors.

You might be able to bring some of your own materials and/or fixtures, such as custom lighting, high-end or very specific appliances, and even pieces of stone or other natural materials that aren't easily reproduced.

With a custom builder, you'll spend more time in the design and selection phases determining all the details. With this approach, you provide the construction financing in the form of a construction loan since the home is specific to you.

Custom homes generally take longer to builder because everything about it is a prototype. It's never been built, so some unique problems will need to be solved during construction. You'll have more flexibility to make changes during construction, but those changes cost both time and money.

With a custom build, you'll invest much more time and energy in the building process. There are more decisions to make, and you'll naturally want to be more involved in every phase of construction. Because it is your vision coming to life, you'll feel a greater sense of connection to the home from start to finish.

Here are a few things to keep in mind when choosing a custom builder:

1. Many of the same things apply as with other builders, such as neat and tidy job sites, employees driving well-maintained vehicles, and not a lot of waste lying around the job site.

2. Progress on the custom builder's job sites will be slower than either the production or the semi-custom builder. This stems from several sources, including longer lead times on custom materials and waiting for specialty contractors that the builder doesn't use on every job.

For the best possible home building experience, decide which kind of buyer you are and look for the type of builder that fits you best. Matching your needs with the builder's process will make for a much more pleasant experience all around.

Since we talk to dozens of people in the market to build a new home in Oklahoma City and surrounding areas, as well as hundreds of realtors working to help their clients find the right builder, we get asked frequently about our thoughts on the many, many builders in the Oklahoma City area.

Building a new home is a big deal. It's a big investment of time and money, the biggest investment most people make in a lifetime. In Oklahoma, there is very little regulation of the home building industry, and it's very difficult for the average person to know how to evaluate all the choices. To make matters worse, there is a very low barrier to entry into the home building business - I think all you need is a pickup truck and a tape measure. How are you supposed to choose?

Building a new home is a big deal. It's a big investment of time and money, the biggest investment most people make in a lifetime. In Oklahoma, there is very little regulation of the home building industry, and it's very difficult for the average person to know how to evaluate all the choices. To make matters worse, there is a very low barrier to entry into the home building business - I think all you need is a pickup truck and a tape measure. How are you supposed to choose?

Unfortunately, I think many people end up choosing by some combination of price per square foot and "standard features" (that term "standard features" makes my skin crawl - as if you are a "standard person" and should just accept what a builder installs "standard" because he thinks that's what you should have in your house... but I digress).

My family has been in the home building business in Oklahoma since 1964. My dad knows just about everyone in the business, and over the last 18 years, I've studied the industry through the lens of a mechanical engineering background.

Seems like we ought to know who the best builders are in Oklahoma City, so it only makes sense to share. So, here is my opinion of the top 3 home builders in Oklahoma City:

Matt has been building fine custom homes in Oklahoma for over 30 years. He is well-known and respected among his peers in the home building industry, and his clients rave about him. One unique thing about Matt is that he is well-respected among the various subcontractors that have worked for him for years, which demonstrates a great deal of integrity.

Beacon has been around since 2003, and I know the two owners, Eric and Andy, personally. You won't find two gentlemen with higher character and integrity, and I know just enough about their business practices to know they run a first-rate business. For the consumer, that means finely-tuned processes that make for an efficient and cost-effective home building process.

Stan and Barbara Malaske started their building company in 1982, and build mostly in eastern Oklahoma County. I only know them by reputation, but that reputation is solid. One little secret about the home building business is that builders and realtors usually don't get along well - because of Stan Malaske's stellar reputation among realtors, I trust Stan's honesty and integrity by that reputation alone. SWM & Sons is a well-respected competitor among builders in eastern Oklahoma County, including Harrah, Choctaw, and areas around Tinker.

These are 3 solid builders to consider if you're wanting to build a new home in or around Oklahoma City.

Good! I hope you do. Homeownership has always been part of the American dream and owning your own custom-built house in Oklahoma makes that dream all the more special. I can’t promise that the land will always be easy to develop or that every builder or banker you talk to will have the expertise you need to achieve your dreams. But I do know that with research and due diligence you will find the tools and the professionals you need to make your homeownership dreams come true no matter the ins, outs, ups, and downs of building that you run into. And if you ever find you need some help, reach out to us at Turner & Son Homes and we’ll be glad to help get you into your forever home.

![]()

6420 W. Memorial Rd.

Oklahoma City, OK 73142

405.285.2856

info@turnerandsonhomes.com

"I can't express enough how thrilled I am with the exceptional service provided by Turner & Son Homes! As a real estate agent, it's imperative to have a reliable and skilled builder to turn to, and Turner & Son Homes exceeded all expectations."

Bryce Wheeler, Real Estate Agent

October 2023